We are at a strategic inflection point. The ongoing Core vs. Knots debate over censorship is not an isolated event; it is a symptom of a fatal cancer growing within Bitcoin. This cancer is the systematic erosion of the very properties that give Bitcoin value: censorship-resistance, decentralization, and fungibility. CSAM on his node/ computer ???

I write this not as an alarmist, but as someone who believes in the cold, hard logic of game theory and the timeless principles laid down by Satoshi, Hal Finney, and Nick Szabo. If we continue on our current path, Bitcoin will not be overtaken by a competitor; it will render itself obsolete.

The Shelling Point We Are Abandoning

Nick Szabo’s concept of a focal point or “Shelling Point” describes a natural solution people tend to choose in the absence of communication because it seems natural, special, or relevant. Bitcoin’s original Shelling Point was as “Peer-to-Peer Electronic Cash.”

The Core development philosophy has actively moved us away from this focal point towards a vague and vulnerable “Settlement Layer for Banks.” This is not a Shelling Point; it is a point of surrender. By conceding the battlefield of peer-to-peer cash, they are handing the entire strategic narrative to regulators and centralizing forces. A “settlement layer” is not a neutral, global, permissionless system; it is a utility for a privileged few, and it will be regulated as such. I can see already many Bitcoiner OG simp for government hand, shill Blackrock hoarding!

Price already stalls, lag behind Gold, they might have created a paper offchain Btc tx scheme.

Hal Finney’s Warning on Privacy

Hal Finney, receiving the first Bitcoin transaction from Satoshi, understood the existential link between privacy and fungibility. He famously said:

“I believe it will be possible for a transparent society to coexist with a private one. We need to be able to choose whether to reveal our actions or not.”

The current Bitcoin protocol makes this choice impossible. Every transaction is a public broadcast of your financial history, creating a permanent, analyzable chain. This isn’t a privacy “feature”—it’s a critical monetary flaw to be upgraded. By ignoring robust, cryptographic privacy at the base layer (or a tightly-integrated sidechain like Grin.mw ), Core is ensuring that Bitcoin can never be the private, fungible money Hal envisioned. It becomes a system where “clean” and “dirty” coins are designated by chain analysis companies, destroying its neutrality and its value as money. Are we sure our btc wont be confiscated as the time we deposited to a CEX or swap ?

The Tit-for-Tat Game Theory of Survival

In the Iterated Prisoner’s Dilemma, the most robust strategy is Tit-for-Tat. You start by cooperating, but you punish defection immediately. What is the “defection” here?

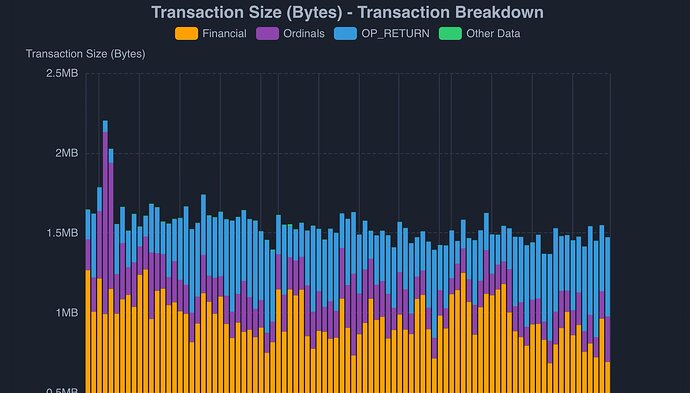

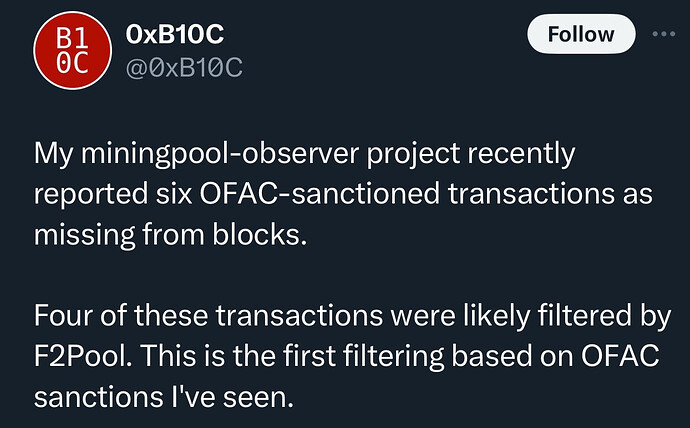

It is the defection of miners and nodes who censor transactions under regulatory pressure. It is the defection of developers who prioritize regulatory appeasement over cryptographic guarantees.

Our current “Tit-for-Tat” response to this defection is… a philosophical debate? A node implementation option? This is not a robust strategy; it is a plea bargain.

We need a cryptographic Tit-for-Tat. A built-in, trustless mechanism that makes censorship non-viable. This is what Mimblewimble (via Grin) provides.

By integrating atomic swaps and making Grin a consensus-friendly sidechain, we create a powerful game-theoretic dynamic:

- If a miner/node tries to censor a Bitcoin transaction, the user can seamlessly and trustlessly atomic-swap their value into the Mimblewimble (Grin).

- The censor gains nothing. The user loses nothing. The censorship attempt is rendered economically irrelevant.

- This moves the fee revenue and economic activity away from the censoring chain and towards the cooperating chain.

This is not creating a competitor; it is giving Bitcoin an immune system. It is a programmed, automatic Tit-for-Tat response that protects the network’s core value proposition.

** Myopic Core Philosophy**

The Core development leadership has consistently ignored privacy and scalability as foundational requirements. They have treated them as afterthoughts, leading to complex, trust-compromised bolt-ons like CoinJoin and Lightning. How many years passed for developing those tools, yet no outcome. Only some developers reap funding from that. Why the hell WEF supports lightning development??

- Lightning it does not solve base-layer fungibility. Its own privacy is a complex patchwork, and its liquidity and channel management create new centralizing pressures.

- CoinJoin requires trust and coordination, and is increasingly being de-anonymized by advanced chain analysis. i cant imagine when Government Ai computing power in play with KYC.

These are sticking plasters on a gunshot wound. Meanwhile, Mimblewimble offers a bulletproof vest: no addresses, no amounts, a tiny blockchain, and full-node capability on a mobile phone. It is the embodiment of the decentralization and privacy principles Bitcoin was founded upon.

Conclusion: Adapt or Die

The choice is no longer between “Bitcoin as it is” and “Bitcoin with privacy.” The choice is between “A Bitcoin with a future” and “A Bitcoin that slowly dies from centralization and regulatory capture.”

If we do not adopt a privacy technology like Mimblewimble, the game theory is clear:

- Fungibility will continue to erode until Bitcoin is a system of “tainted” and “untainted” coins.

- The cost and regulatory burden of running a node will centralize the network into a few compliant data centers.

- The “Settlement Layer” will become a permissioned system for approved entities, and the dream of peer-to-peer electronic cash will be dead.

The tools exist. Grin is live, functional, and perfectly suited for this role. The proposal for standardized atomic swaps is not a distraction; it is a lifeline.

We must return to our Shelling Point. We must heed Hal Finney’s warning. We must implement a robust, cryptographic Tit-for-Tat against censorship. The blame for our current trajectory falls on those who refuse to see this, and who, through their inaction, are making Bitcoin obsolete day by day.

The path forward is clear. Integrate Mimblewimble, or betray the very revolution we started and we again bow to fiat slaves and confiscation with KYC frankestein rules.