This analysis examines the fee estimation data from Block 846887 to 847322, covering a total of 435 blocks, to analyze the difference between estimates from Bitcoind Policy Estimator conservative and economical modes.

Methodology

- Logged and traced

conservativeandeconomicalfee estimates every minute. - Logged and traced all connected blocks’ percentile fee rates (Branch implementation).

- Collected and cleaned data from both the traced and debug logs (Data).

- Analyzed the data, plotting Bitcoind

conservativeandeconomicalestimates against the confirmed block target (50th - 5th percentile fee rate range).

Definitions

conservativemode: This is theestimatesmartfeeRPC mode which considers a longer history of blocks. It potentially returns a higher fee rate and is more likely to be sufficient for the desired target, but it is not as responsive to short-term drops in the prevailing fee market.economicalmode: This is theestimatesmartfeeRPC mode where estimates are potentially lower and more responsive to short-term drops in the prevailing fee market.- Overpaid Estimates: An estimate above the 50th percentile fee rate of the target block.

- Underpaid Estimates: An estimate below the 5th percentile fee rate of the target block.

- Estimates Within Range: An estimate that falls between the 5th and 50th percentile fee rates of the target block.

Data Summary for Bitcoind estimatesmartfee

A total of 7822 estimates were made from 2024-06-07 12:18:25 to 2024-06-10 07:48:05 from Block 846886 to Block 847321, with confirmation targets of 1 and 2.

| Estimator | Overpaid Estimates | Underpaid Estimates | Estimates Within Range |

|---|---|---|---|

| Bitcoind Conservative | 3760 (96.14%) | 66 (1.69%) | 85 (2.17%) |

| Bitcoind Economic | 3033 (77.55%) | 433 (11.07%) | 445 (11.38%) |

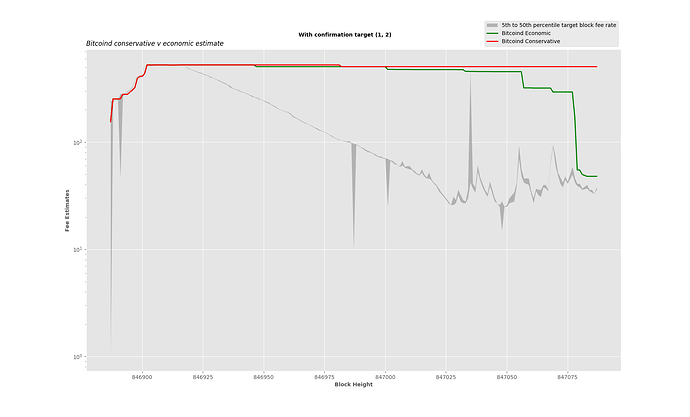

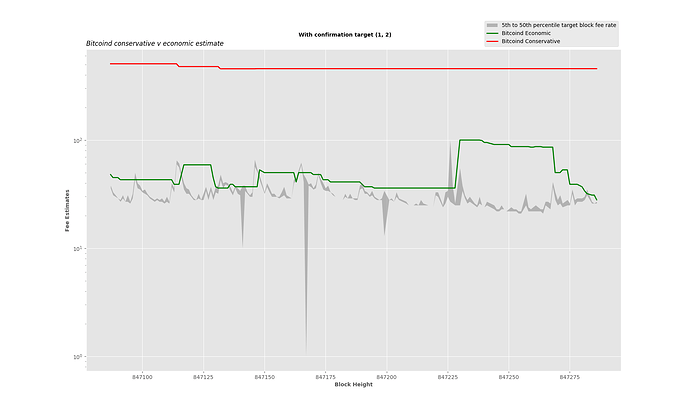

Logscale Graph

Estimates from block 846887 to block 847087 plotted on a log scale:

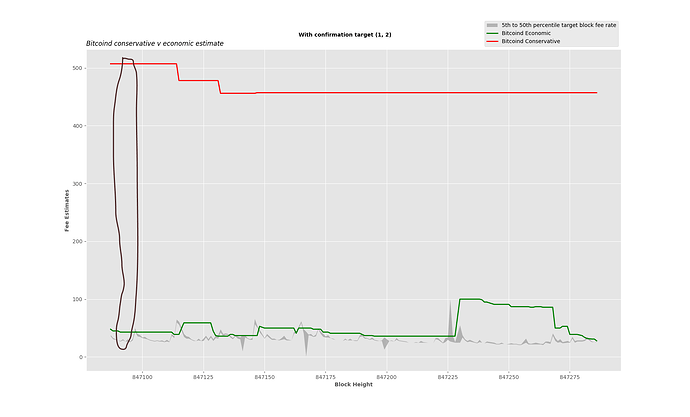

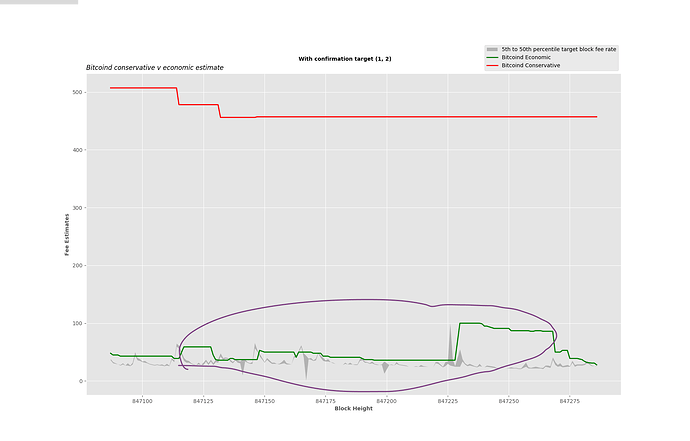

Estimates from block 847087 to block 847287 plotted on a log scale:

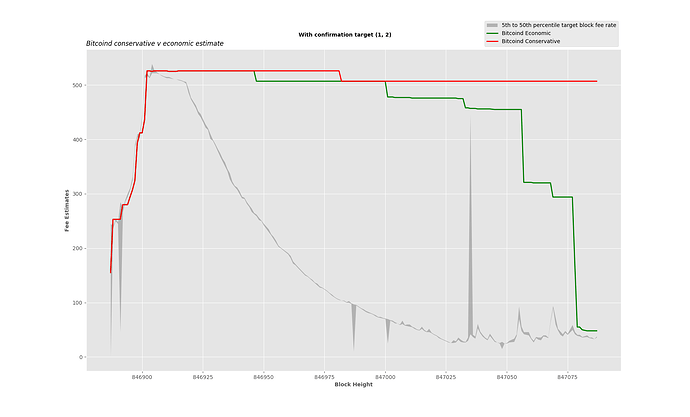

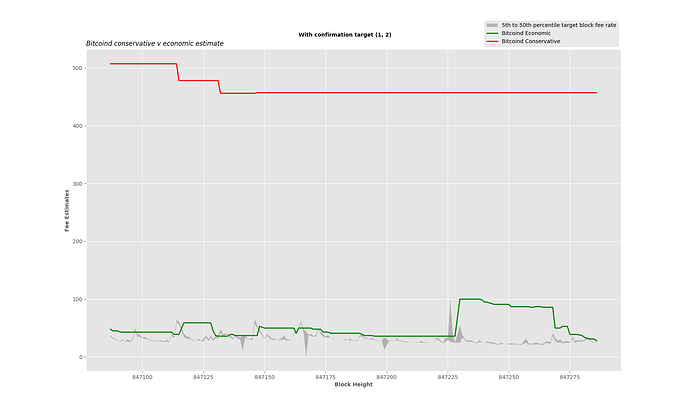

Absolute Values Scale

Estimates from block 846887 to block 847087 plotted using absolute values:

Estimates from block 847087 to block 847287 plotted using absolute values:

You can recreate these graphs, summaries, and more from the repository using the branch ‘analyse-bitcoind-estimates’: Fee Estimates Analysis.

Key Findings

- This empirical data shows that the economic mode has a much lower overestimation compared to the conservative mode. The previous analysis used the economic mode. There was an issue reporting this claim in Bitcoin issue #30009. These graphs show that the economic mode responds much quicker to recent fee market adjustments than the conservative mode.

How significant is the overestimation by estimatesmartfee conservative mode?

Here is a worst case scenario estimate for block 847088 or 847089:

Block 847088 was confirmed with a 50th percentile fee rate of 38.7 sat/vB.

estimatesmartfeeconservativemode was an excessive505.7sat/vB.estimatesmartfeeeconomicalmode was much lower at48.3sat/vB.

Many transactions paid this high fee to get included, as seen here.

For an average P2WPKH 2-input 2-output transaction weighing approximately 208.5 vbytes, the costs are:

- Bitcoind Economic estimate:

208.5 * 48.3 = 10071 satoshis (≃ $6.73) - Bitcoind Conservative estimate:

208.5 * 505.7 = 105438 satoshis (≃ $70.52)

Using the conservative estimate results in paying 15 times more than necessary to get included in the block. This excessive overestimation continues for quite some time, causing many transactions to overpay.

This analysis reveals that the overestimation by the estimatesmartfee conservative mode is not an isolated incident but a recurring trend. The significant discrepancy in fee estimates, as seen in the case of Block 847088 and more, where the conservative estimate was more than ten times higher than necessary, warrants modifying the default estimation mode to economical given the current fee market behavior.

Rapid adjustments are frequent, it is imperative to adopt a more responsive fee estimation mode to reduce paying more than necessary.